Can SRRV holders access healthcare and medical facilities in the Philippines?

Yes, SRRV holders have full access to public and private healthcare facilities in the Philippines. The country offers modern hospitals and clinics in major cities such as Manila, Cebu, and Davao, with English-speaking doctors and internationally trained specialists. Many retirees also obtain private health insurance for added protection and convenience. The Philippines’ affordable yet high-quality healthcare system is one of the major attractions for foreign retirees. ★

Is there a minimum stay requirement per year for SRRV holders?

No, there is no strict minimum stay requirement for SRRV holders. You may leave and re-enter the Philippines freely without losing your visa status, as long as you maintain your annual report and keep your PRA deposit active. This flexibility allows retirees to travel internationally while still maintaining their residency in the Philippines. ★

Can SRRV holders invest in businesses in the Philippines?

Yes, SRRV holders can invest in businesses as long as they comply with Philippine investment laws and regulations. Many retirees invest in restaurants, resorts, or service-oriented businesses. However, they must ensure compliance with the Department of Trade and Industry (DTI), Securities and Exchange Commission (SEC), and Bureau of Internal Revenue (BIR). This allows retirees to enjoy both financial and lifestyle benefits. ★

What is the cost of living for SRRV holders in the Philippines?

The cost of living for SRRV holders in the Philippines is significantly lower than in Western countries. A comfortable lifestyle for one person can range from USD 800 to USD 1,500 per month, including housing, utilities, food, healthcare, and entertainment. The affordability of living, combined with the tropical environment and friendly locals, makes the Philippines one of the best retirement destinations in Asia. ★

Can SRRV holders send their children to school in the Philippines?

Yes, SRRV holders with dependents can enroll their children in Philippine schools. The country has many excellent international schools offering American, British, and IB curricula, especially in cities like Manila and Cebu. Tuition fees are also more affordable compared to Western countries, making the Philippines an ideal place for family relocation. ★

What currency should be used for the SRRV deposit?

The SRRV deposit must be made in U.S. dollars through a PRA-accredited bank in the Philippines. Once deposited, the funds are placed in a time deposit account under the retiree’s name. In some cases, the deposit can later be converted into an investment or refunded upon visa cancellation. ★

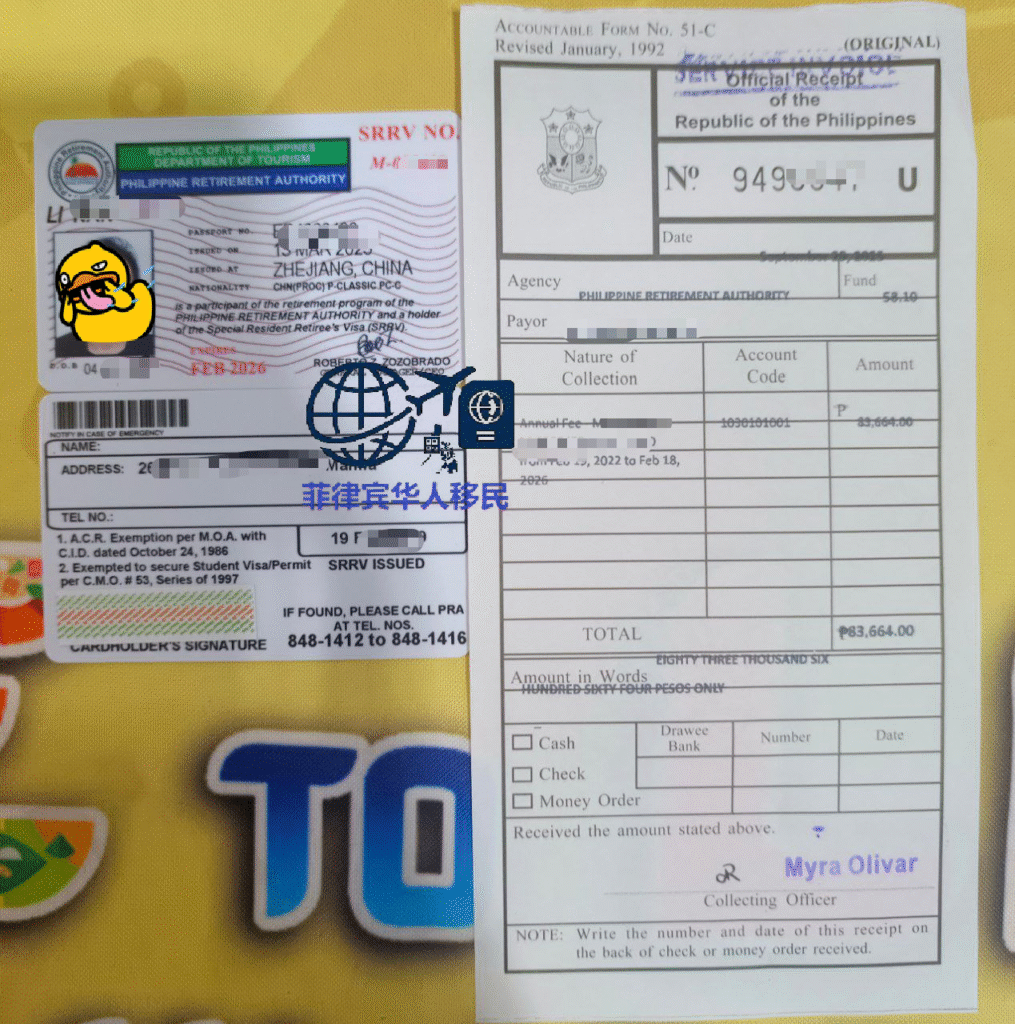

Are there different SRRV programs for various types of retirees?

Yes, the PRA offers several SRRV options — such as SRRV “Smile,” SRRV “Classic,” SRRV “Human Touch,” and SRRV “Courtesy.” Each caters to different applicants. For example, “Human Touch” is for retirees needing medical care, while “Courtesy” is for former Filipino citizens or retired foreign officers. This flexibility makes the SRRV suitable for a wide range of applicants. ★

Can former Filipino citizens apply for the SRRV?

Yes, former Filipino citizens who have acquired foreign nationality can apply for the SRRV under the “Courtesy” program. This plan requires only a USD 1,500 time deposit and offers the same privileges as other SRRV programs. It’s an excellent option for balikbayans (returning Filipinos) who wish to retire in their homeland. ★

What happens if an SRRV holder passes away?

If an SRRV holder passes away, the principal’s dependents can still remain in the Philippines if they meet the eligibility requirements or transfer the visa sponsorship to another family member. The time deposit will be released to the legal heirs after proper documentation and approval by the PRA. ★

Can SRRV holders purchase local insurance or property protection plans?

Yes. SRRV holders are eligible to purchase local insurance, property protection, and even investment-linked plans through accredited Philippine providers. These services help protect assets and ensure financial security during retirement. Many retirees choose to insure their homes, vehicles, and health to maintain peace of mind while living abroad. ★

针对以上话题您是否想了解更多?欢迎联系我们咨询

English/Tagalog Inquiries :

WeChat : dpylanayon

Telegram : @Diadem_Pearl

EMAIL: dplanayon.royalewonders@gmail.com

VIBER: +63 939 526 6731 / +63 9176523432

WhatsApp / PHONE: +63 9176523432

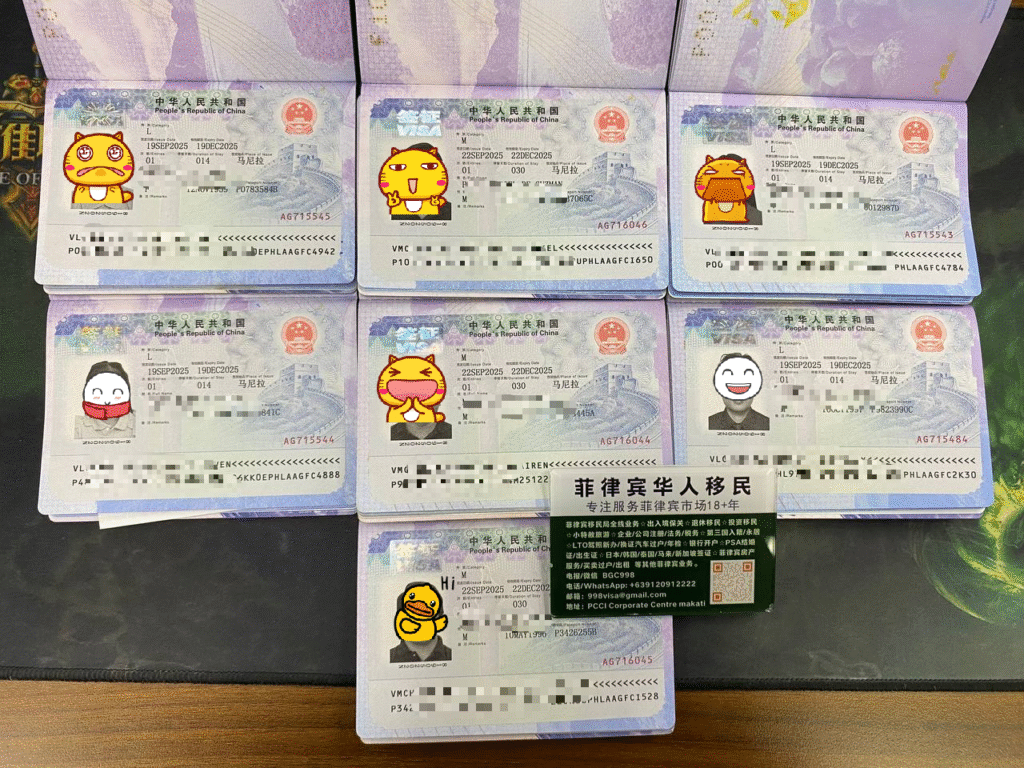

中文咨询

微 信:BGC998 电报 @BGC998 或 微信:VBW333 电报 @VBW777

菲律宾998VISA是菲律宾MAKATI 实体注册公司,在菲律宾已经有超过19年服务经验,客户隐私安全保护服务可靠,业务提交可以安排工作人员上门取件或前往我们办公室提交。菲律宾政策时常变化,且信息发布有时间差,有需要相关业务最新资讯欢迎联系我们。

欢迎关注我们的电报TELEGRAM频道

998官方资讯频道 @FLBYM998

日常案例分享频道 @FLBYM998CASE