★ 1. Can SRRV retirees bring household goods or personal items duty-free when moving to the Philippines?

Yes. One of the special privileges of SRRV holders is the duty-free importation of up to USD 7,000 worth of household goods and personal effects. This benefit allows retirees to move their essential belongings—such as furniture, appliances, and personal items—into the Philippines without paying customs duties, provided they arrive within 90 days from the visa issuance date.

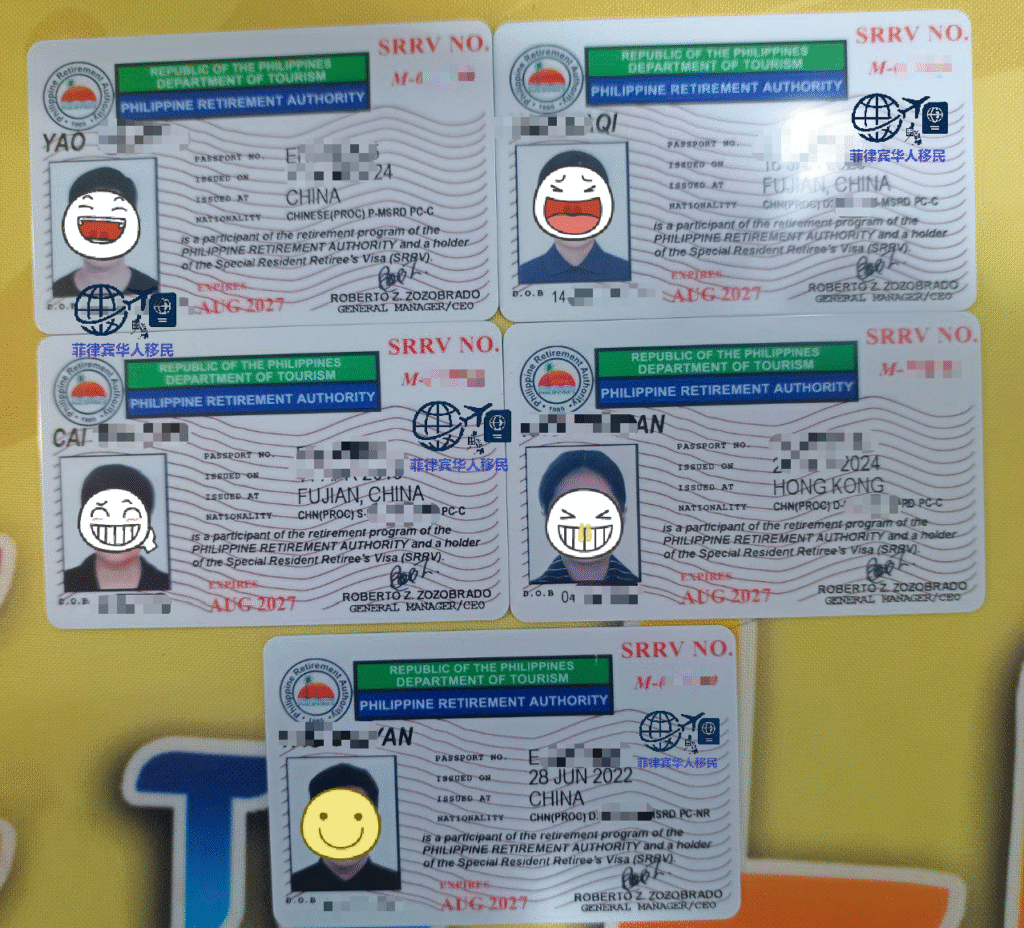

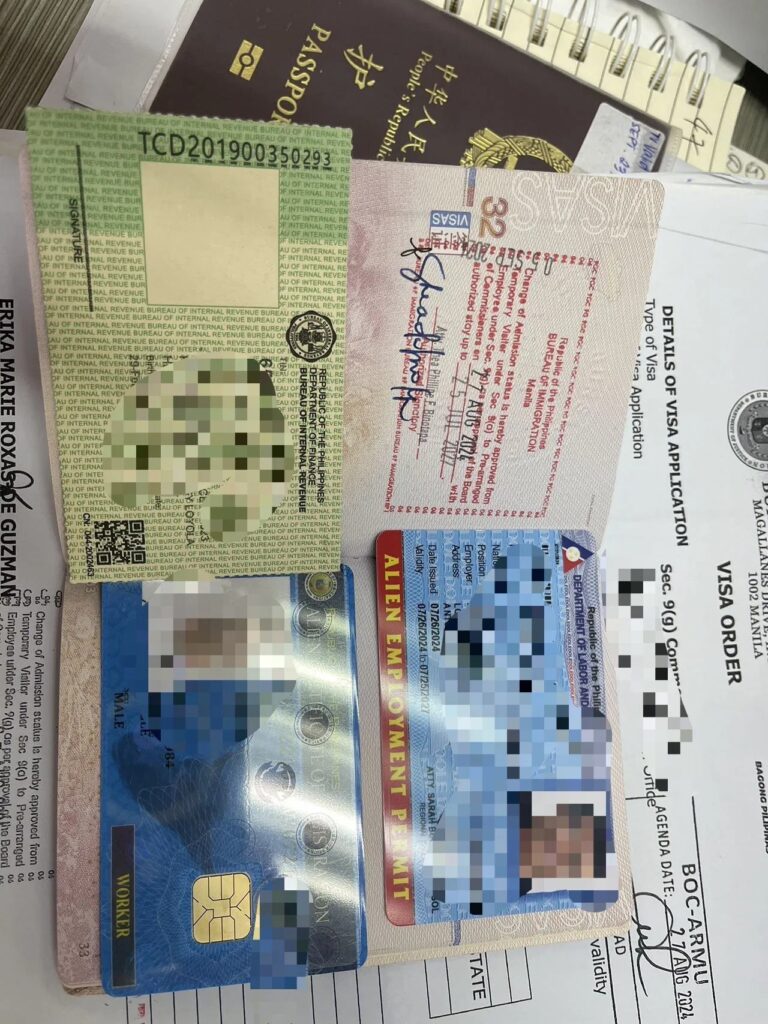

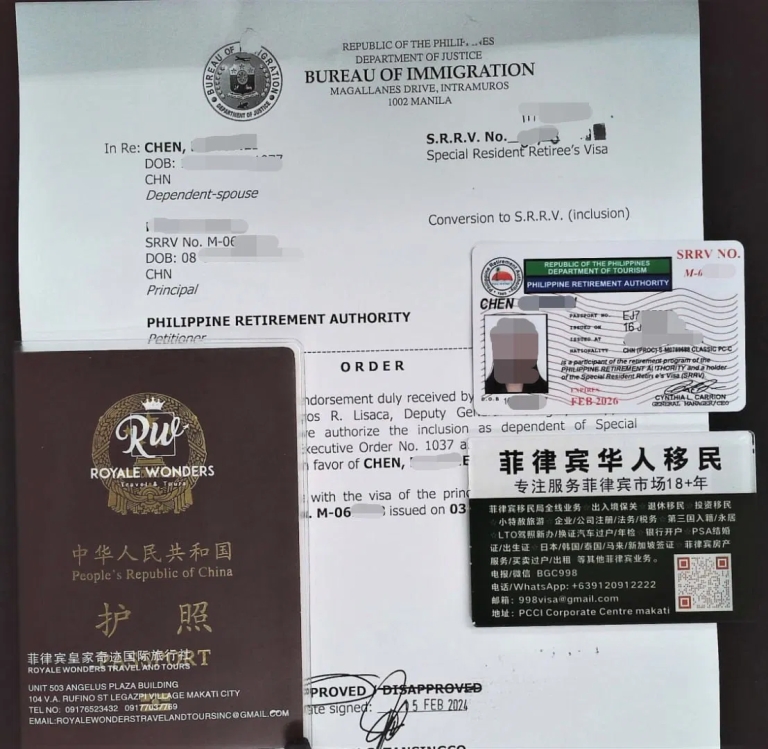

★ 2. What documents are required to apply for the SRRV visa?

Applicants must prepare the following: a valid passport, SRRV application form, medical certificate, police clearance from the home country, NBI clearance (if applying in the Philippines), proof of pension or bank deposit, and passport-sized photos. All foreign documents must be authenticated by the Philippine Embassy or Consulate before submission.

★ 3. Can former Filipinos apply for the SRRV visa?

Yes. The SRRV Courtesy program specifically welcomes former Filipino citizens aged 35 and above. It requires a reduced time deposit of USD 1,500 only, making it one of the most affordable and flexible options for balikbayans (returning Filipinos) who wish to live permanently in the Philippines again.

★ 4. Is there a minimum stay requirement for SRRV visa holders each year?

No, there is no mandatory minimum stay requirement for SRRV holders. You can leave and re-enter the Philippines freely, and your permanent resident status remains valid. However, you must renew your SRRV ID card annually to keep your membership active with the Philippine Retirement Authority.

★ 5. Can I convert my SRRV Classic to another SRRV category later?

Yes. The PRA allows conversion between SRRV types if your circumstances change. For example, a retiree on the SRRV Smile plan may later switch to the Classic plan to use their deposit for a condominium investment. Your deposit will simply be reclassified and transferred according to the new program’s rules.

★ 6. Do SRRV retirees have to pay income tax in the Philippines?

Retirees under SRRV who receive income from abroad, such as pensions or savings, are exempt from Philippine income tax. However, income earned from Philippine-based businesses or employment is taxable under local regulations. Most retirees enjoy full tax benefits by keeping their retirement income offshore.

★ 7. Can SRRV visa holders drive and obtain a Philippine driver’s license?

Yes. SRRV visa holders are eligible to apply for a Philippine driver’s license through the Land Transportation Office (LTO). They can either convert their valid foreign license or take a driving test if needed. Having an SRRV makes it easier to prove legal residency for license issuance.

★ 8. What are the main reasons people choose SRRV over permanent residency by marriage (13A visa)?

Many retirees prefer the SRRV because it is independent of marital status—it remains valid even if personal circumstances change. The SRRV also offers lifetime validity, no need for annual visa extensions, and multiple-entry privileges. In contrast, the 13A spouse visa is dependent on maintaining a valid marriage and requires periodic renewals.

★ 9. How does the SRRV help retirees access healthcare and insurance in the Philippines?

The SRRV makes it easier for retirees to register with local healthcare providers and enroll in medical insurance plans. Many private hospitals recognize SRRV members, and several international insurers, such as Cigna and Pacific Cross, provide coverage specifically for foreign retirees residing in the Philippines.

★ 10. What should I do if I lose my SRRV ID card or passport?

If you lose your SRRV ID card or passport, you must report the loss immediately to the Philippine Retirement Authority and the nearest police station. After submitting a notarized affidavit of loss, a replacement card or visa transfer can be processed within a few weeks. Always keep a photocopy of your documents as backup to avoid complications.

针对以上话题您是否想了解更多?欢迎联系我们咨询

English/Tagalog Inquiries :

WeChat : dpylanayon

Telegram : @Diadem_Pearl

EMAIL: dplanayon.royalewonders@gmail.com

VIBER:+63 939 526 6731 / +63 917 652 3432

WhatsApp / PHONE:+63 9176523432

中文咨询

微信:BGC998 电报:@BGC998

或 微信:VBW333 电报:@VBW777

菲律宾998VISA是菲律宾MAKATI实体注册公司,在菲律宾已经有超过19年服务经验,客户隐私安全保护服务可靠,业务提交可以安排工作人员上门取件或前往我们办公室提交。菲律宾政策时常变化,且信息发布有时间差,有需要相关业务最新资讯欢迎联系我们。

欢迎关注我们的电报TELEGRAM频道

998官方资讯频道 @FLBYM998

日常案例分享频道 @FLBYM998CASE